Oct. 31st, 2025 Option Outlook

Happy Halloween!

Good Morning! A spooky market drop of 1% a day after bearish FOMC rhetoric.

The one thing I want to note is about spot-vol betas. Yesterday upon a drop we saw major undervixing. We also saw positive vol increases as we rose for the whole week prior. There isn’t anything wrong with this, but it is a huge hint that Volland may be right about dealer positioning. It is reversed from the normal “GEX” assumption of bought puts and sold calls by customers. GEX practitioners are probably a bit confused by the current market action since we are in the midst of a lot of call OI, which means they think we are deeply positive gamma (which should take away large whipsaw), but yet we are seeing huge swings that are exceeding the bounds of expected moves based on straddles. Volland subs are seeing that we are actually in the midst of a large swath of negative gamma. What else do Volland subs see?

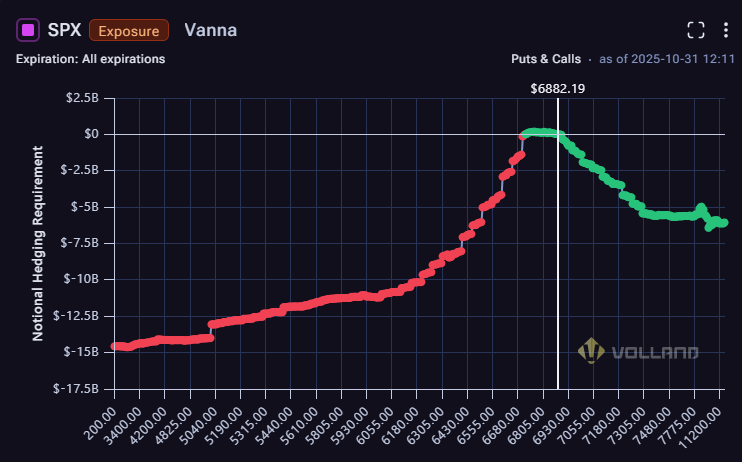

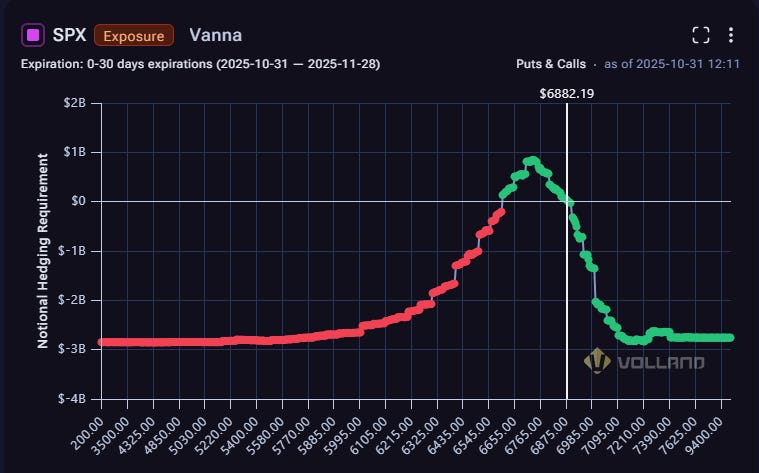

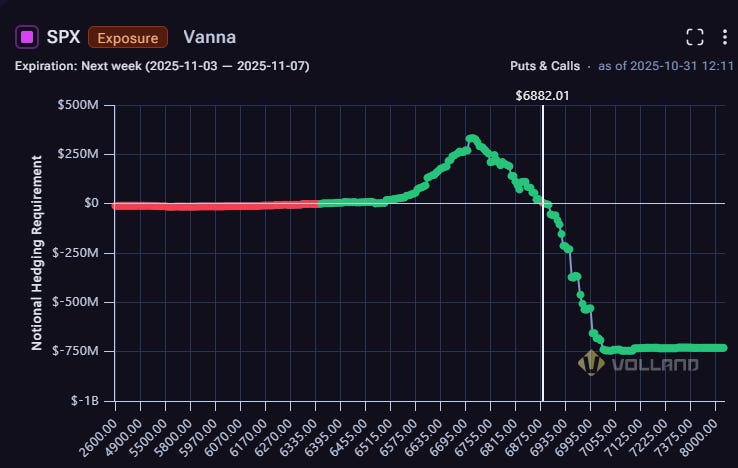

Across all tenors we are seeing strong negative vanna. That’s the first thing I notice when I see Volland data. The all expiration vanna hasn’t looked like this since 2022, and honestly, I think upon the dawn of the new year we should see similar price action. It will seem to be a weak, slow downturn that takes its time, never overvixes, and feels relentless. There is still a chance for a breakout beforehand, however, if we can get above 6950 next week and convert this negative vanna into positive over the next week. I don’t think that will happen, but it is possible and cannot be completely counted out.

In the near term, we will continue to see increasing daily volatility. This doesn’t necessarily mean that we will close 1-2% away from the prior day’s close but will constantly frustrate day traders with swift reversals and frustrate options traders with strong overnight moves.