Oct. 23rd, 2025 Option Outlook

FOMC in the dark?

Good Morning! A session filled with strong whipsaw closed down .5%

The news yesterday was that ADP has stopped providing the FOMC with free labor market data. ADP is a private payroll vendor for 20% of the private workforce. That is a more comprehensive dataset with a better “response rate” than the BLS jobs data! It is an example of how the government can be collecting data better. While I have not seen ADP comment about this, it seems like it is because they recognize the value of it and want to be compensated.

Once again, in a drop we overvixed. It isn’t a vol event signal, but it shows that the expanded spot-vol beta regime is not over, and there’s still more digestion to go. When that digestion happens, what will happen in markets?

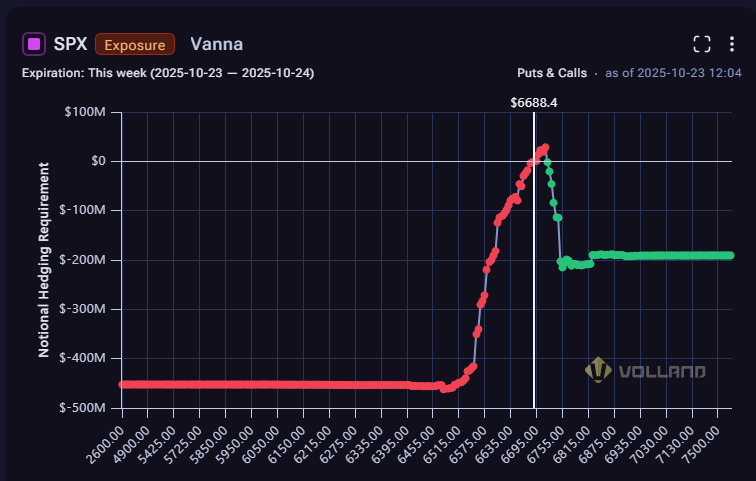

This week’s vanna has changed every day. Yesterday there was a little bit of support below spot, and today that is gone. It looks like markets are primed for a collapse as far down as 6600 with peeking below. Yesterday we got as low as 6650, so this doesn’t seem unrealistic. NFLX and TSLA earnings both had negative price action as shown in their similar vanna profiles.

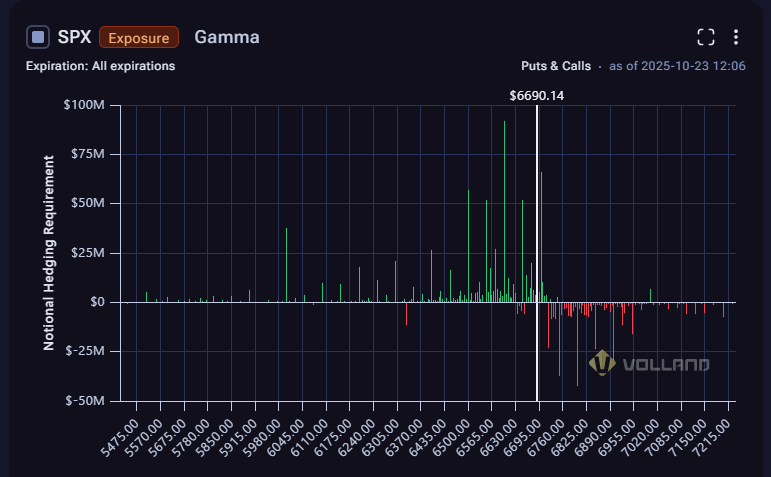

While this is true, this drop could be a lot slower than people realize. The positive gamma will mean that dealers almost have a self-fulfilling hedge on the way down in the form of gamma. On net, we should see downside, but it could take some time to get to the targets. These mini catalysts have been “overreacted” in order to drop markets to these targets. Overall, this is the same environment we saw in 2022 when markets slowly burned to the downside with little vol reaction. Vol is mispriced right now, but when it is done hashing out its issues, this is the same environment we can expect until the option outlook reverses again.