Oct. 20th, 2025 Option Outlook

Friday Rally

Good Morning! On Friday we saw a rally pop markets up .5%.

It is strange to think this rally is happening without economic data. There’s some earnings reports which are generally coming back positive but bifurcated. The finance world is seeing amazing profits, but you should expect that with bond steepening and many risk assets (like gold and equities) squeezing to all-time highs. We can expect record profits from tech companies as AI investment seems to be boosting profits (although at this point it is circular). But there are plenty of sectors feeling pain.

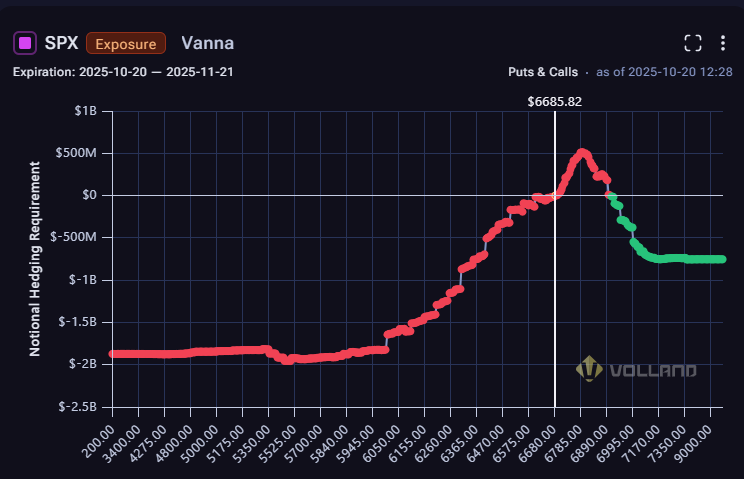

In the end, flows are what determines markets. The economy can be in the dumpster, but it doesn’t mean anything if no one is selling. What are the future flows looking like from an options standpoint?

This week looks remarkably bullish. There is a lot of resistance ahead, but it looks like we can modestly bump up for the week.

The problem is that’s all the bullishness we see going into November. There is a path to the upside if markets can pop past 6785-6800 and momentum takes over, but this is not the most likely path. The most likely path is a pop, possibly satisfying the first vol event signal, followed by a precipitous drop and more vol events starting possibly next week.