Nov. 3rd, 2025 Option Outlook

Constant whipsaw

Good Morning! Another day where the closing gain of .25% doesn’t do the intraday swings justice.

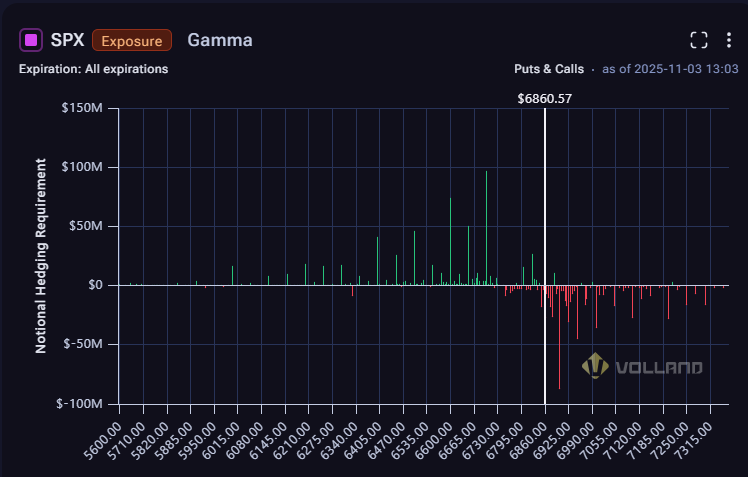

There were a lot of earnings over the past week as well as an FOMC decision, and the whipsaw began in earnest. We are in negative gamma territory, so volatility is on the menu. How far does the market have to go before we are in positive gamma territory again?

If the market accelerates to the upside, we can expect a lot more whipsaw, but if the market drops, we can expect the market to begin to calm down. There is some near term positive gamma below price that could provide a small base for the market, but ultimately, we should expect the market to slow only upon a drop to 6700.

The market is currently inverse of option positioning typically is. We are seeing calls bought and puts sold by customers, so you can expect a rocky, sustained drop that isn’t terribly acute even if there is an acute drop somewhere in the middle of it on a swing basis. The danger of that exists down to 6750. Once we drop down past 6800, that’s when the slow downside progression can take hold probably until closer to the end of the year when price agnostic collars begin to be applied.