Good Morning! A strong advance yesterday that saw the SPX close +100 points.

Yesterday satisfied the vol event signal on March 10th, making 18 successes and 1 loss of the vol event signal. As a reminder, a vol event is when we overvix by 2 points or more. When that happens, our studies have shown we return to the previous day’s close within 3 weeks. There seemed to be some confusion because I expressed that we overvixed before that day quite a bit, and that was true, but it was never by more than 2 points. I had also started that the whole way down that despite the overvixing, I wanted to see a vol event to cap a low… and we got that on March 10th. If you remember, March 11th started the undervixing that happened for a week straight as well. Sure, I also started collecting profits at 5900, I had a lot of profits and I wanted to protect them. I didn’t sell all my shorts until 5675 the trading day before the vol event. I wasn’t expecting that vol event to happen on Monday. In fact, on March 7th I started accumulating a long position to be caught off guard by March 10th but added to longs from the vol event. Now that the overvixed signal is satisfied, is the door open for downside now?

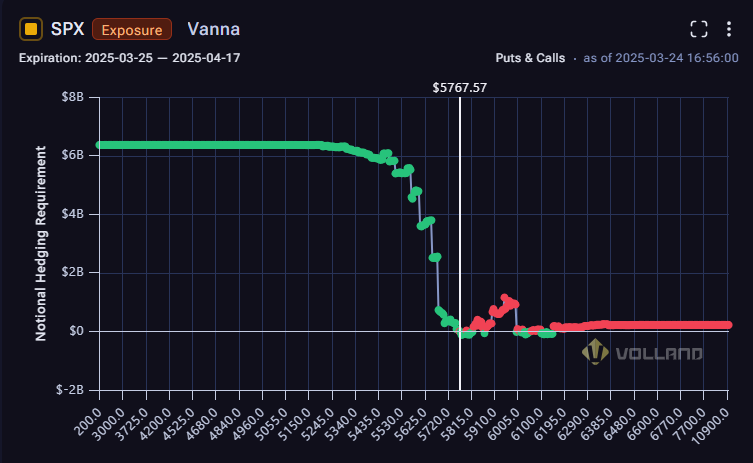

The short answer is no. Especially into March 31st, we have a lot of support. After March 31st, it is a lot less certain.

To break out to the upside, we need to see a breach of 6000. At this point I don’t see that happening unless it were to somehow happen before March 31st. There is still support for April, but not even close to as much. There is strong resistance at 5900-5950 will be more difficult to overcome if it isn’t done by March. 300 points in 1 week is a tough ask, although we did get 100 points yesterday. So it isn’t impossible, but I wouldn’t play for the breakout until we get to 5900. Let’s get to that level and see where to go from there.