Good Morning! I have never seen a completely flat SPX close in my life, I wonder if it ever has happened. But the .02 point change yesterday was as close as I ever saw.

While SPX appeared flat and had modest intraday RV, there were some interesting developments. The most profound was the destruction of IV. Vol was reduced significantly despite the flat close. Using spot-vol correlation, SPX should have been up roughly 1% yesterday, but spot declined as vol declined. This is normal after a major overvixing or after a known event, but theoretically the ceasefire (an unknown event) produced two straight days of strong undervixing. It seems it is more from premium selling, a force that has become quite strong over recent weeks. We had stated 6100 would be a pretty decent resistance, and it seems to be functioning as that now. Will that continue?

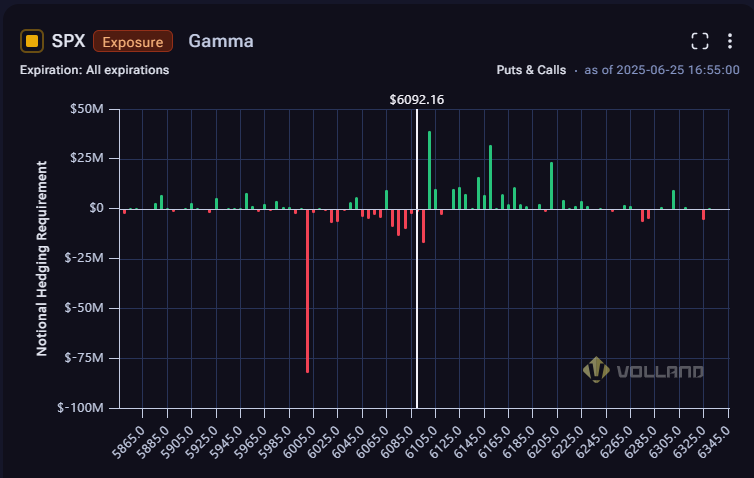

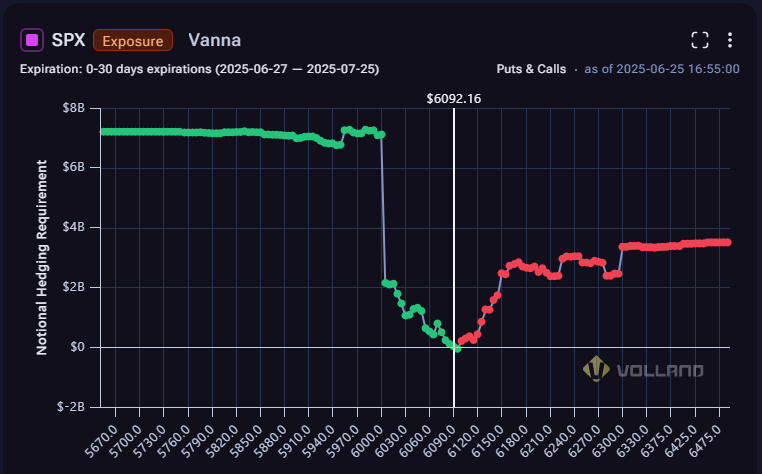

Because we are so close to 6100, it doesn’t show up much on the vanna chart, but it shows up quite prominently on the gamma chart. 6100 should be a magnet at least going into Monday.

However, that strong 6000 short gamma, long vanna strike that is both dealer long calls and puts is prominent. Any sort of downturn, and 6000 gets cut through like swiss cheese right now. There is a little bit of support building over the next month, and primarily because of that 6000 strike, we are seeing a lot of positive vanna.

Despite that, it is curious that IV coming down isn’t more bullish. I know 6100 is a strong resistance and we had some strong undervixing to get to this point, but VIX moves like yesterday should have produced a stronger SPX response in this environment. Because of that, I’m not so sure we are primed for more of a breakout. This is undervixing due to premium selling, not a normalization from an event or prior overvixing. This can result (eventually) in an IV breakout, blowing out those premium sellers. When and how that happens, I don’t know… But the return to risk for premium selling is already negative. Eventually they stop or the market forces them to.