Good Morning! A rally after the cease fire between Israel and Iran rose SPX 1.1%.

In prior substacks, I mentioned that if the markets rose past 6000, likely from a catalyst, then it can quickly ascend to 6100, where we will encounter some initial resistance. 6000 is a very strong negative gamma strike, so I wasn’t expecting it to act as resistance, but yesterday qualified as a breakout. Additionally, vol dropped dramatically, undervixing by 1.4 points. While undervixing doesn’t work the same as overvixing, it validates the idea that the 6100 area is strong positive gamma for dealers while 6000 was strong negative gamma. How can we expect markets to behave into the end of June?

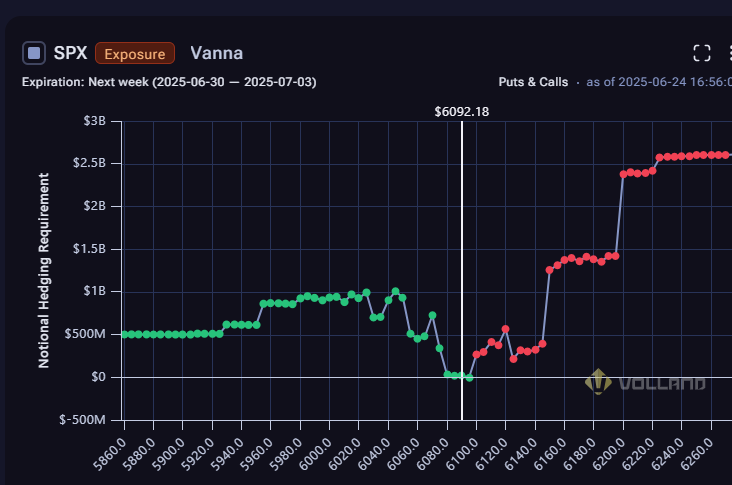

While aggregate vanna has bumped up, it has been primarily through ITM options. The JPM strike at 5905 is now fully hedged. The 6000 strike vannas are dealer short calls and puts, meaning customers have bought straddles at that level. There are also dealer long calls at 5950 and 5975 that are mostly fully hedged. In order to advance more from here, the validation of a breakout to the upside would be a spot-up, vol-up environment to get above 6100 convincingly.

While that’s true, the downside argument is still far more compelling, especially considering the fiscal situation America has put themselves in. Trump’s tariff deadline is on July 9th, and there’s a budget bill that has a large fiscal deficit that Trump wants passed by July 4th. Further, the markets are much higher now than when the Israel-Iran war started. You would need trade deals to really move the needle to the upside.

From a Volland standpoint, there are many ITM long calls for dealers, many of which are for the 30Jun expiration. These calls are fully hedged, so their expiration would need significant delta replacement to prevent a strong dealer-imposed selloff of $13B in notional value. JPM will account for a little more than half of that notional delta replacement. Any more advancement past 6100 will create more delta notional to sell off. The 6000 strike options expire in July, so if there’s a selloff, 6000 will not act as support. As of now we wouldn’t get dealer support until below 5900. If you are bullish, I would most certainly hedge.