Good Morning! After the American attack over the weekend, the market strongly recovered to close 1% higher.

I had said yesterday that if the market was to get over the 6000 hump, it would need a catalyst. We got that catalyst in a cease fire over what seemed to be the scariest of the current active wars. The premarket is also up .8% currently, now approaching all time highs. This was not my most likely scenario, but one that needed to be hedged for if bearish. However, there are still economic issues that aren’t addressed, and the tariff deadline is right around the corner. What changes were made in the market in response to this catalyzed rally, and will this rally be sustained?

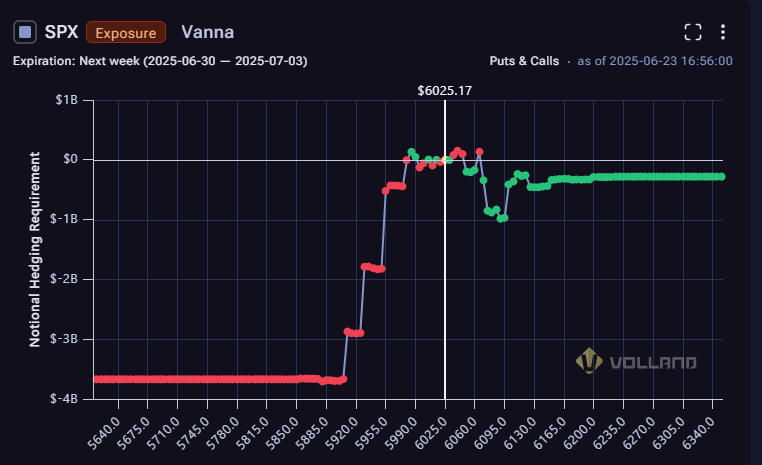

With this rally, this week went from slightly negative vanna to almost vanna neutral.

For next week, the huge negative vanna strikes are still there, and it looks like the premarket has escorted the price into that little valley, which will increase the aggregate vanna b a little over $1B notional.

On all tenors, 6100 seems to be the beginning of active resistance.

Yesterday’s rally was highly suspicious. On two separate occasions we saw clear short squeezing on the order flow, as a lot of capital came in bullish and forced some buying on the offer. From a Volland standpoint, a key component is missing… no one sold calls. When we climbed above 6000, which were customer speculative synthetic longs that leaned on the call side, I was expecting to see some call covering at that point to consider this rally authentic. That didn’t happen. Instead, yesterday’s price action had the appearance of speculative buying. Knowing what we know now… that a cease fire was in the works… it seems like some heavyweights who knew something was happening were buying unhedged yesterday and into this morning. The fact that oil and gold prices were dropping contributes to that thesis.

If that is true, this rally will be short lived. In fact, we may even fill the gap today since people with that kind of capital do not stay in the market unhedged when they don’t have an edge. Further, the tariff deadline is quickly approaching along with a budget bill with massive fiscal deficits in an already debt-filled situation. These problems have not gone away. The Volland landscape confirms this suspicion. I’d be interested to see what Volland brings during the day, but at this point, I think this is a pop to sell.