Jan. 7th, 2026 Option Outlook

Bullish push

Good Morning! Markets rose another .6% close to all-time highs.

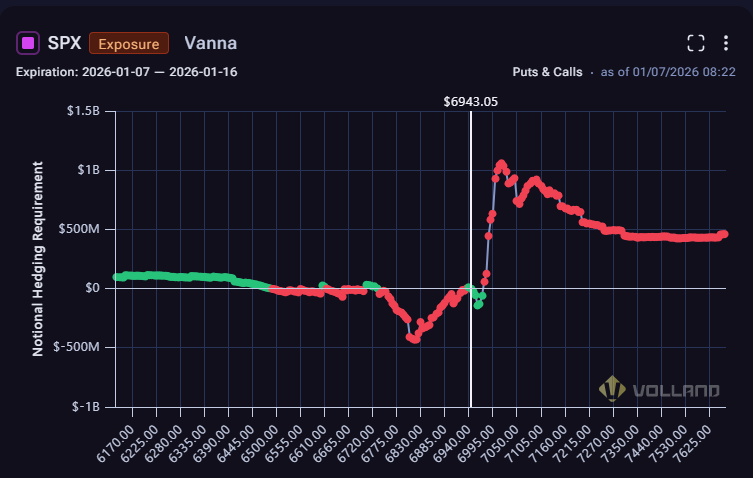

Once we passed 6900, there was a negative gamma gap that ran to 6950. I didn’t know if we’d hit it yesterday morning, but we did and the run ensued. Tomorrow is NFP data, and markets have seen overvixing going into it the past two days. This makes sense considering we ran into a negative gamma, negative vanna run to the upside. Where should we start looking for a top?

Going into Jan opex, and really the end of this week, there are a lot of calls sold up to SPX 7000. When I trade, I identify a risk I’m willing to accept, and that risk is that we will not get above 7050 with only a small chance of passing 7000. Downside is generally possible, but there isn’t much support until we reach 6800. On the upside there’s a lot of resistance here and it is within range to put on some options positions to take advantage of that.