Good Morning! The FOMC was cautious, but some news prior to the press release had SPX starting from a lower point. The result was a dip, then a modest loss to close the day.

As I expected yesterday, the FOMC was cautious, pausing rate cuts until there was clarity in the data. They are clearly not happy that inflation is remaining elevated but seem to be satisfied with where the labor market is. JPow also made a concerted effort not to get too political. The one political comment of note was towards the beginning, he said he has not been in contact with Trump. I figured Trump would at least call him to ask to lower rates, but I guess Trump didn’t even try. Trump later said he would have to take inflation matters into his own hands, which was confusing because lowering rates would juice inflation, not constrain it… but also correct, inflation at this point is in Trump’s hands. From a market perspective, is 6100 off the table now?

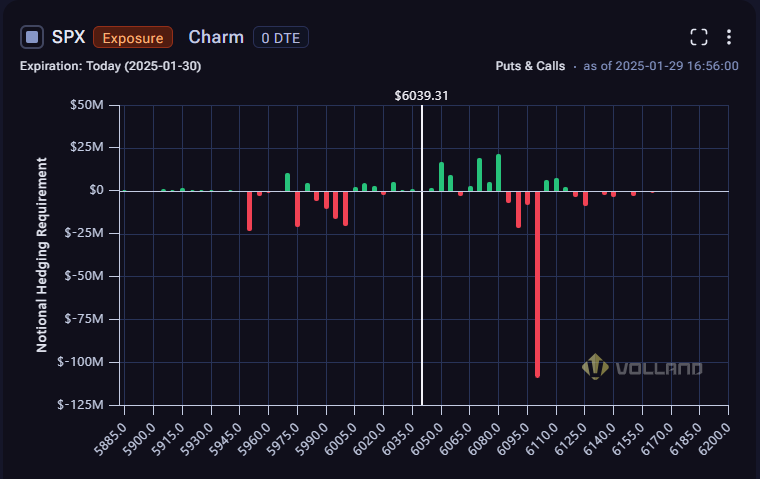

Surprisingly, IV did not crash as much as it should have yesterday. It remains a bit elevated going into the overnight, and it appears it is now beginning to overvix pre-market. This could be an earnings thing, trying to account for 3 of the MAG7 earnings yesterday (will comment on the paid post about those). Regardless, 6100 going into Friday is still a huge magnet, and is also a huge magnet today as seen in the initial 0DTE chart above.

With the 0-30 day monthly chart, we still see the clear support and resistance at 600 on the downside (followed by 5900) and 6100 on the upside. My impulse is we will play pong between these two strikes until February opex. If you took the condor I mentioned on the Schwab network last week, you are sitting pretty.