Good Morning! Yesterday saw a nice rebound into the 0DTE target area, closing up strongly. Tech rebounded from the fundamental scare the day before.

In this backdrop, we have FOMC and a lot of earnings after the market closes today. The earnings were dealt with in a paid sub post yesterday, so I will focus a bit on the FOMC today. Fundamentally, FOMC is expected to hold rates, and I expect a neutral stance. The data that came in wasn’t compelling enough to raise or cut, and the whirlwind of executive orders and their execution by Trump might give the FOMC slight pause. JPow will of course be asked about Trump’s attacks on interest rates, but JPow will likely remain defiant. How do the options look for FOMC?

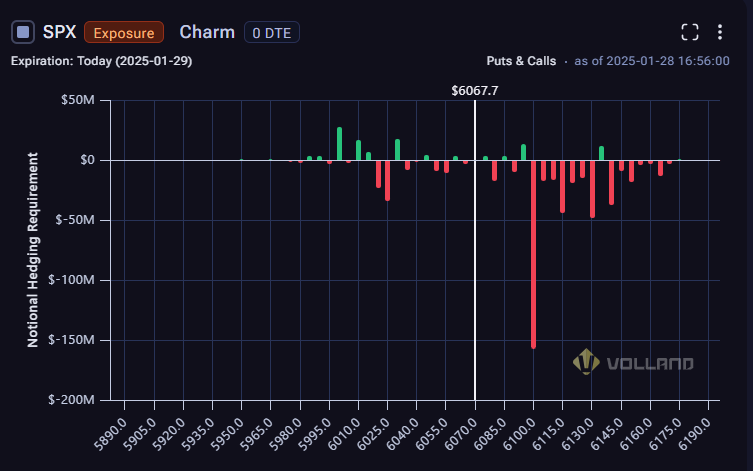

First, the 0DTE looks bullish, with a strong pull up to 6100. On FOMC day, that will usually stay consistent, as many normal 0DTE participants stand pat.

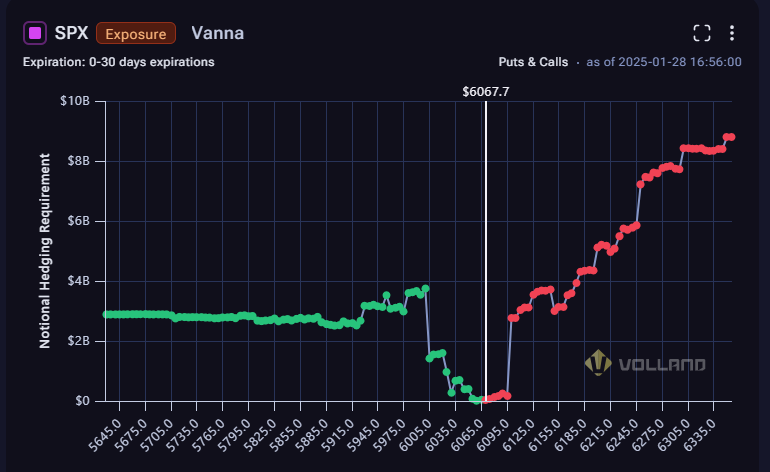

The one month (which includes 0DTE and this week’s options) show a similar look, with $11B in aggregate vanna. That makes the analysis easy, if FOMC is seen as fundamentally neutral, the market will likely trend up to 6100 and peek a little bit over, probably closing at ATH or thereabouts. Of course, I must emphasize that this implies the FOMC is going to be neutral. If FOMC is seen as favorable, we can get as high as 6150-6175, and if the FOMC is seen as unfavorable, the huge strike to overcome is 6000 with a possible swift move down to 5900 by the end of the week if that fails. If 6000 does not fail today, I would expect to buy the dip into next week. The expected move is 40 points, which is about the same as it was for last FOMC. However, this time there is some put support underneath which wasn’t there in December. Because of that, I will be leaning bullish with small risk. Something like a 6080/6115/6150 fly if I can get it at the right price.