Good Morning! The market strongly rose again yesterday and slammed into the brick wall that is 6100.

Yesterday’s post broke down the various tenors of the book and saw that 6100 on multiple tenors would be a strong force for a long while. This isn’t to say it will be impossible to pass, but it would require a lot of outside flows to force its way, and that is more difficult in regular trading hours when liquidity is high. That means the market needs a catalyst. Is the Bank of Japan decision tomorrow going to do it?

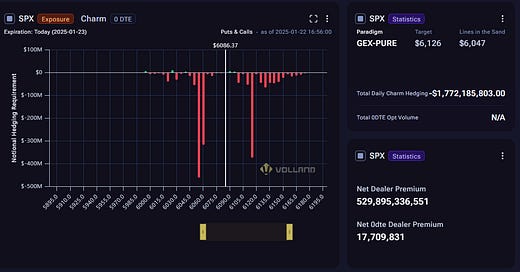

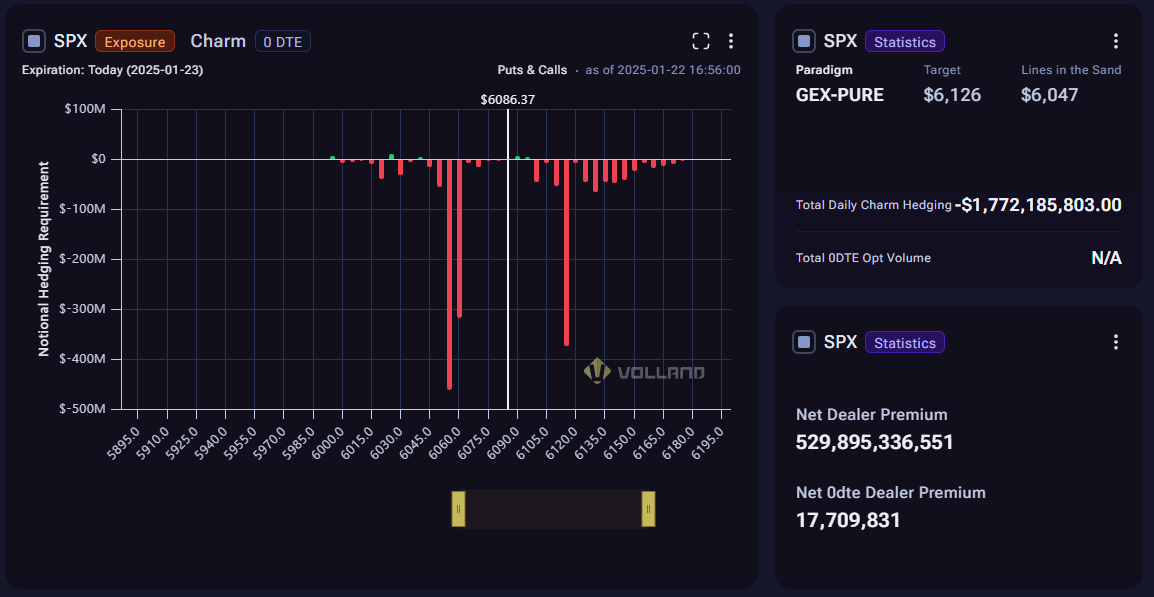

The preliminary 0DTE (which can immediately change at the open, so take it for what it’s worth), is showing a bullish formation up to 6115, meanwhile, for this week and next, 6085 is where we stick at max vanna, with a very strong support and resistance on both sides of that strike, with 6100 and 6050 as strong bounds.

Even though we rushed to 6100, meeting the Feb opex target rather quickly, this is probably a stopping point for a decent amount of time.

That is, unless there’s a catalyst, especially in the after hours. And the BoJ could provide one tonight. Gov. Ueda has telegraphed Friday’s interest rate hike, but will he be further hawkish? With Trump taking office, I expect Ueda to telegraph which evil he prefers. Does he prefer higher inflation to fight negative trade rhetoric or a stronger Yen that can tighten Japan’s import economy? He’s stuck between a rock and a hard place, and if he telegraphs that he will aggressively raise rates, the market can sell off. The most likely outcome is he will be neutral and say things like he’ll wait for events to unfold, etc.

There is very little event vol for tomorrow, so the market can get caught off guard. If it does, I would look to buy the dip.